PHILLIPS After Covid19(Nautilus Fever)

COVID-19の世界的不況で、当然ですが時計業界も大きな影響を受けました。バーゼルは中止、ロレックスもパテックも新作の発表は延期に。多くの工場も操業がいったん止まって、殆どのブランドは売上を大きく落としました。セカンドマーケットの方でも、まず現行のロレックスのデイトナやサブが 3月頃から軒並み下落。どうなるのか、、、と思っていたらその後、急激に反発し回復と、感染の世界的状況の見通しが立たずに混乱していた印象でした。

そんな中、初めてジュネーヴでのPHILLIPS の 時計オークションが開催されたのですが、高額なモデルやヴィンテージがどうなるのか、という意味で注目が集まりました。結果から言うと、全体的には反発し大幅に高騰。特に一部のノーチラスが爆発しました。

こちらは所謂初代ノーチラスのジャンボ 3700 の11本しか製作されなかったホワイトゴールドのモデル。1978年製。11本と限られた存在のモデルとはいえ、予想を大きく覆す74万CHF(=邦貨8,367万円)という驚きの結果。Estimate上限でのハンマーでしたね。ケースシェイプの崩れた3700よりは、エッジが立った新品に近い5711の方が高い傾向にあったのですが、これで3700がまた見直されるかもしれませんね。ノーチラスってケースが磨かれて丸っこくなると、魅力が半減する時計なので、3700はケースシェイプが重要だと思います。

こちらは所謂初代ノーチラスのジャンボ 3700 の11本しか製作されなかったホワイトゴールドのモデル。1978年製。11本と限られた存在のモデルとはいえ、予想を大きく覆す74万CHF(=邦貨8,367万円)という驚きの結果。Estimate上限でのハンマーでしたね。ケースシェイプの崩れた3700よりは、エッジが立った新品に近い5711の方が高い傾向にあったのですが、これで3700がまた見直されるかもしれませんね。ノーチラスってケースが磨かれて丸っこくなると、魅力が半減する時計なので、3700はケースシェイプが重要だと思います。

こちらは2016-17年にかけて1,300本限定で製造された40周年のWGモデル。限定とはいえ1,300本は多めだと言われてきました。それでも当時から 「定価で買えれば、プレミアがつくだろう」とは時計好きは予想してはいましたが、ノーチラスとしては高額な当時の定価(1,135万円)もあって、オファーがあったけど見送った方もいましたね。それがわずか3年で、今回は何と48万CHF(=邦貨5,500万円)という異常な高騰ぶり。最近のマーケットプライスはいいとこ250Kくらいでしたから、今回の結果を受けてまた上がりそうです。しかしパテックがこの40周年モデルを発表した時、なぜWGとプラチナで、このデザインなんだ?と不思議な部分もありましたが、この結果を見ると彼らの先を見る目は素晴らしかった事がわかります。今にして思えば「WGモデルはクロノ、プラチナは3針」という設定は見事でした。

こちらは2016-17年にかけて1,300本限定で製造された40周年のWGモデル。限定とはいえ1,300本は多めだと言われてきました。それでも当時から 「定価で買えれば、プレミアがつくだろう」とは時計好きは予想してはいましたが、ノーチラスとしては高額な当時の定価(1,135万円)もあって、オファーがあったけど見送った方もいましたね。それがわずか3年で、今回は何と48万CHF(=邦貨5,500万円)という異常な高騰ぶり。最近のマーケットプライスはいいとこ250Kくらいでしたから、今回の結果を受けてまた上がりそうです。しかしパテックがこの40周年モデルを発表した時、なぜWGとプラチナで、このデザインなんだ?と不思議な部分もありましたが、この結果を見ると彼らの先を見る目は素晴らしかった事がわかります。今にして思えば「WGモデルはクロノ、プラチナは3針」という設定は見事でした。

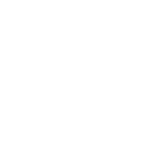

バージルらファッション系のセレブリティの愛用(彼のはセラミックモデルのカスタムですが)もあって空前のブームがきてるAPのパーペチュアル。このモデルはステンレスで限定50本のグリーン文字盤のモデル。これも2019年で 殆ど現行モデルのような時計。国内定価は786万円でしたが、それが今回18万CHF(=邦貨2,050万円)との結果。

バージルらファッション系のセレブリティの愛用(彼のはセラミックモデルのカスタムですが)もあって空前のブームがきてるAPのパーペチュアル。このモデルはステンレスで限定50本のグリーン文字盤のモデル。これも2019年で 殆ど現行モデルのような時計。国内定価は786万円でしたが、それが今回18万CHF(=邦貨2,050万円)との結果。

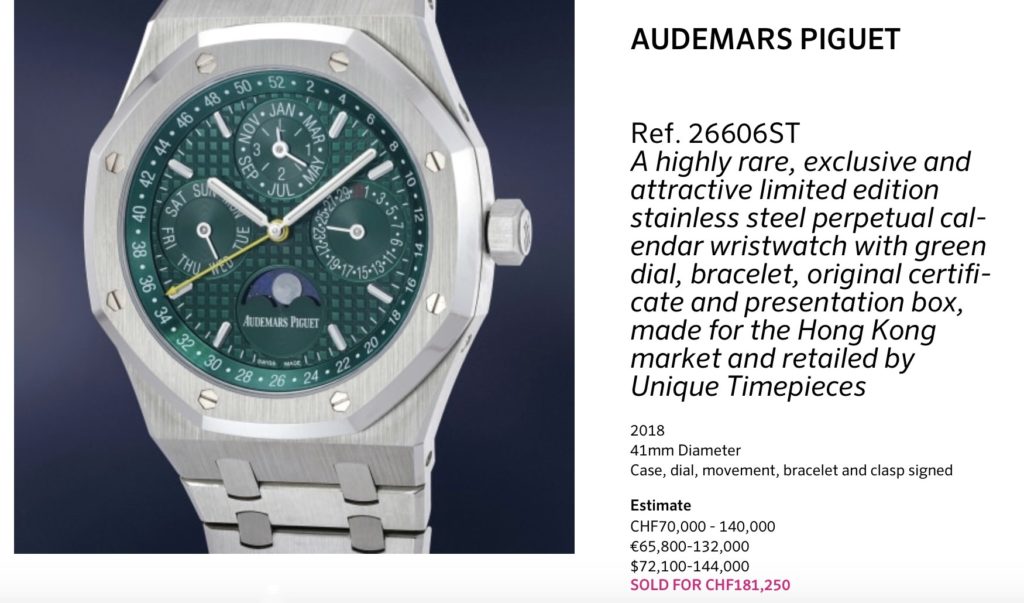

JPSはついに1ミリオンを突破。こちらもEstimate上限を超えての850Kでのハンマーでしたね。JPSとしては勿論、過去最高のリザルトでした。こうなってくると4日後のサザビーズのシャンパンの金ポールも、影響を受けて上がるかもしれませんね。

JPSはついに1ミリオンを突破。こちらもEstimate上限を超えての850Kでのハンマーでしたね。JPSとしては勿論、過去最高のリザルトでした。こうなってくると4日後のサザビーズのシャンパンの金ポールも、影響を受けて上がるかもしれませんね。

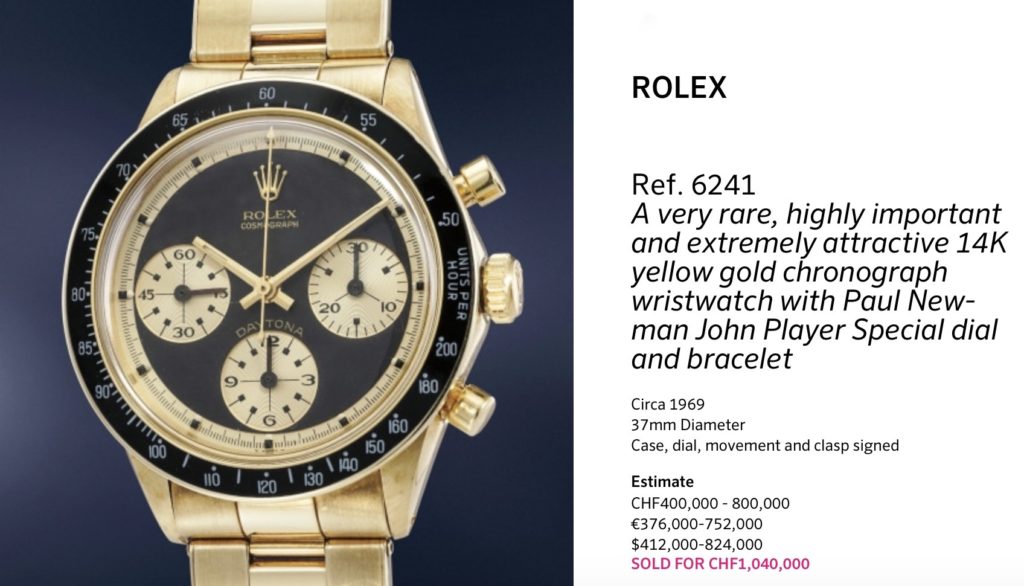

PHILLIPSが自信を持って高めのEstimateをつけていた6200は40万CHF(=邦貨4,500万円)でした。もちろんこれも立派な結果でしたが Estimate 250-500で、320のハンマーですからオークション側からしたら、期待外れの結果だったのかもしれません。ですが、そもそもベゼル無しの状態にしてはEstimateが高すぎただけで、この400Kは妥当なマーケットの評価だと思われます。

PHILLIPSが自信を持って高めのEstimateをつけていた6200は40万CHF(=邦貨4,500万円)でした。もちろんこれも立派な結果でしたが Estimate 250-500で、320のハンマーですからオークション側からしたら、期待外れの結果だったのかもしれません。ですが、そもそもベゼル無しの状態にしてはEstimateが高すぎただけで、この400Kは妥当なマーケットの評価だと思われます。

1日目の総括としては、ヴィンテージ系は全てが高騰という訳でもなく、やはりアイコニックなモデルに人気が集中。マニア向けの違いが分からないような文字盤のモデル(6263FAPなど)は今回、弱かった印象。今後もコンディションの良いポールニューマンなどは強いと思われます。また一方で、2010年以降製造の一部のモダンウォッチも高騰が凄い。AP(オーデマ)のパーペチュアル系と3針、Patekはノーチラスとアクアノート、ヴァシェロンのパーペチュアル…この辺りはかつてないほど上がってます。お店では絶対に買えないのでマーケットの枯渇感が凄く、ディーラーにとっても動きが良い(仕入れてもすぐに売れる)ので、どんどん高値になるスパイラルができあがってますね。この辺りのモデルはそもそも定価も高いですし どこでも買い取ってくれますから安心感もあったのでしょう、世界的COVID-19の不安という状態のなか ニーズが集中したという側面もあると思います。もちろん現行のデイトナやサブ、GMTなどの鉄板モデルは3月頃に急落したかに見えましたが、6月には結局のところほとんど回復し、一部はコロナ前より上がりました(GMTバットマンは生産数が多いため少し下落)。

コレクター側としては自分の好みに合うモデルで、価値が下がらないモデルに出会えたら 資産価値を維持したまま 長く楽しめるという状況は変わってないと言って良いと思います。

- Keywords:

- Patek Philippe

- Rolex